CULTURE

Never promise what you can’t deliver. These are the words we bank on. At American Business Bank, people are our greatest asset. We believe in building honest relationships — not client rosters — and we work relentlessly to protect our clients’ interests, while driving their businesses forward through strong balance sheets and stable practices.

Relationship Banking

Banking is banking; and while many banks offer similar services, no one customizes like ABB.

Learn MoreInternational Banking

The world is getting smaller by the minute. Fewer and fewer US companies are operating in domestic only sectors.

Learn MoreConsulting & Referral Services

ABB knows good people. We understand the nuances of your business and aim to provide heartfelt wisdom.

Learn More

INVESTOR RELATIONS

Never promise what you can’t deliver. These are the words we bank on. At American Business Bank, people are our greatest asset. We believe in building honest relationships — not client rosters — and we work relentlessly to protect our clients’ interests, while driving their businesses forward through strong balance sheets and stable practices.

Every relationship we foster, decision we make or action we take all derive from a single core principle - trust.

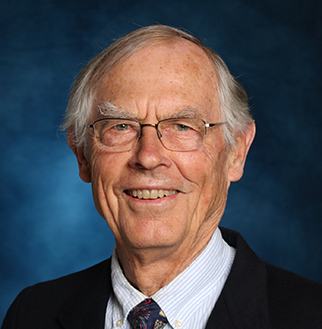

Leon Blankstein

CEO and Director

ABB Ranked In 2026 Top Performing Companies Traded on OTCQX

ABB Promotes Weatherill to Regional Vice President, Inland Empire Region

American Business Bank Promotes Eric Dole and Chris Basirico to Executive Officers

American Business Bank Opens New Loan Production Office in Downtown Riverside, California

American Business Bank Declares Cash Dividend